Google has a wide range of media planning tools that when combined, provide actionable insights for marketers. Whether you are developing an online media plan from scratch or iterating on an existing campaign, you can never have too much market intelligence at your fingertips. Every time a user enters their query into a search engine, they are expressing their interest in a particular topic. In this way, search history can be considered database of users interests. Insights for Search is the version of Google Trends designed for Marketers and it allows anyone (Google customer or not) to use this expansive user interest database to discover market tendencies, patters and trends. By making this data free and easily accessible, Insights for Search accellerates the media planning process allowing marketers to discover in minutes what used to require deep pockets and months of research. Here are 5 examples of how Insights for Search can be used to answer some real-life business questions. Click on the embedded links to see each example in action.

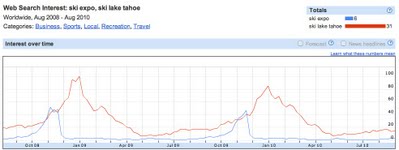

Timing Marketing Campaigns. User interest related to a product or service is often seasonal and tends to be concentrated in a few spikes. Thus, it's very important to make sure online marketing campaigns are ready to go in time to capture as much user interest as possible. By comparing the volume of user queries for "ski expos" to the interest in the "ski lake tahoe", we can see the period of time when a ski resort would want to focus their efforts on industry events such as expos versus potential guests planning ski vacations. The search trends show that it would make the most sense to the ski resort to launch their campaigns in early October, but by November shift focus away from trade shows and towards vacation planners.

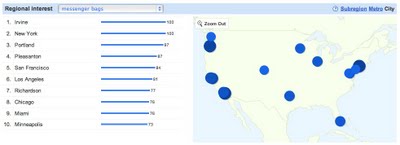

Determining Regional Focus. Limited marketing budgets result in limited campaign scope. Consequently, marketers must choose where they can get the most impact for their money. If I sold messenger bags out of my garage and was trying to figure out where to open my first retail store I could use Insights for Search to find out which US metro areas are most interested in my products. While there are many factors involved in where to build a store, demand a key factor. Based on the chart below I would look for good retail spaces in Irvine, New York and Portland.

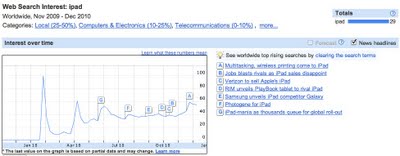

Measuring a Campaign's Impact. One of online media's greatest benefits is its ability to be tracked and measured. Marketers are often asked to estimate the impact of a campaign but this process can be expensive and usually takes a long time to gather conclusive results. Insights for Search is a quick and effective way to access how marketing and PR campaigns impact web searches. A great example is the launch of the iPad because "iPad" was not even a word before before Steve Jobs announced it's pending release on January 27th 2010. The largest spike of searches for the term "iPad" to date happened around the announcement, not the launch months later. It's essential to have marketing campaigns ready before previews, rumors and announcements so you can make sure to take advantage of these spikes in user interest.

Discovering Local Differences in Language and Brand Affinity. With Insights for Search, you can quickly compare the relative popularity of brands over time and geography as well as the words used in searches. With one Insights for Search query I can find out the most popular laptop computer brands in Australia, as well as the subtleties of how Australians use the terms "laptop" and "notebook". The top searches report shows that Toshiba, Dell, HP and Asus are top of mind to Australian consumers, but if you dig a bit deeper you can see that Australians associate the word "notebook" most strongly with HP while the word "laptop" is more closely connected to Toshiba and Dell.

Imagine how much time and money it would take to answer any one of these 5 questions using a traditional phone, direct mail or email panel. Additionally, a panel is only as good as its design and its subjects. With 597 million unique visitors/month worldwide (Source: comScore Networks, March 2008), no panel can match Google's scale. On a related note, if you are in the import/export business or are looking to expand to international markets check out Google Export Adviser. This tool was build for the UK market, but the information Export Adviser provides is relevant to any business that sells goods internationally.

*The most common question I get asked about Insights for Search is "What do the numbers on the graph represent?" Check out Google's answer here.

Share:

The Two Most Insightful Reports in the Google Ads Interface

The Two Most Insightful Reports in the Google Ads Interface